StudentShare

Our website is a unique platform where students can share their papers in a matter of giving an example of the work to be done. If you find papers

matching your topic, you may use them only as an example of work. This is 100% legal. You may not submit downloaded papers as your own, that is cheating. Also you

should remember, that this work was alredy submitted once by a student who originally wrote it.

Login

Create an Account

The service is 100% legal

- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

✕

- Studentshare

- Subjects

- Finance & Accounting

- Financial Analysis of Apple Inc

Free

Financial Analysis of Apple Inc - Example

Summary

An analysis of the performance of the organization in 2013 will enable the firm to determine its areas of weakness and concentrate on improving them in the next financial year. A…

Download full paper File format: .doc, available for editing

GRAB THE BEST PAPER96.4% of users find it useful

- Subject: Finance & Accounting

- Type:

- Level: Business School

- Pages: 4 (1000 words)

- Downloads: 0

- Author: jschmeler

Extract of sample "Financial Analysis of Apple Inc"

Analysis of Apple Inc Analysis of Apple Inc Apple Inc has been termed as the most dynamic organization in the twenty first century.An analysis of the performance of the organization in 2013 will enable the firm to determine its areas of weakness and concentrate on improving them in the next financial year. A justification of how the company may improve its value chain may also help it to improve its quality and gather a larger market share.

Apple Inc aims at producing its original products with unique software and hardware that can attract customers. Although this is a well-built strategy, the organization needs to invest in more research to find out the tastes and preferences of customers. This is because increase in customer value may only be obtained if the firm provides them with the goods that they deserve. Researching the customers’ requirements will help the company to increase customer value, expand sales, and earn higher profits in the forthcoming years than in 2013.

Apple Inc should also ensure that it employs qualified personnel in all its distribution channels so that they can deliver goods to customers in the right manner. This is because employees are the main spokespersons of the organization, and it means that even if the goods produced are based on customers’ requirements, poor communication will lead to loss of value. Return on investment = net profit/investment * 100

Year

Return on investment

2013

37,037/207,000* 100 = 17.89%

2012

41,733/176,064* 100 = 23.70%

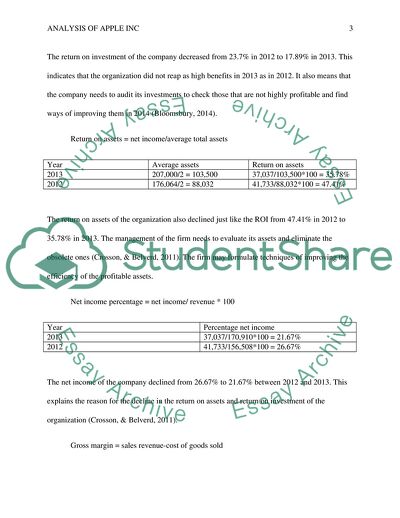

The return on investment of the company decreased from 23.7% in 2012 to 17.89% in 2013. This indicates that the organization did not reap as high benefits in 2013 as in 2012. It also means that the company needs to audit its investments to check those that are not highly profitable and find ways of improving them in 2014 (Bloomsbury, 2014).

Return on assets = net income/average total assets

Year

Average assets

Return on assets

2013

207,000/2 = 103,500

37,037/103,500*100 = 35.78%

2012

176,064/2 = 88,032

41,733/88,032*100 = 47.41%

The return on assets of the organization also declined just like the ROI from 47.41% in 2012 to 35.78% in 2013. The management of the firm needs to evaluate its assets and eliminate the obsolete ones (Crosson, & Belverd, 2011). The firm may formulate techniques of improving the efficiency of the profitable assets.

Net income percentage = net income/ revenue * 100

Year

Percentage net income

2013

37,037/170,910*100 = 21.67%

2012

41,733/156,508*100 = 26.67%

The net income of the company declined from 26.67% to 21.67% between 2012 and 2013. This explains the reason for the decline in the return on assets and return on investment of the organization (Crosson, & Belverd, 2011).

Gross margin = sales revenue-cost of goods sold

Year

Gross margin

2013

$170,910- $106,606 = $64,304/170,910*100 = 37.62%

2012

$156,508 - $87,846 = $ 68,662/156,508*100 = 43.87%

The gross margin of the firm also reduced from 2012 to 2013. This means that the efficiency of the manufacturing and distribution departments declined. The firm needs to correct the inefficiencies in these divisions to avoid a declining trend in 2014.

Contribution margin = net sales - total variable expenses

Year

Contribution margin

2013

$170,910 - $ 15,305 = $155,605:170,910

0.91:1

2012

$156,508 - $ 13,421 = $ 143,087:156,508

0.91:1

The firm maintained a contribution margin of 0.91:1 in both years meaning that the organization managed to cover its fixed costs and contribute to profit (Baker, & Filberk, 2013). This also indicates that the firm is able to control its costs, and this also means that the management should concentrate on improving efficiency in all departments.

Apple Inc uses Joint Operating Command Systems because the products of the company have access to the internet through application produced by other firms. The organization has synchronized applications such as emails, music, photos, and documents into the devices that it produces. Therefore, the synchronizations indicate that Apple uses JOCS.

References

Baker, H. K., & Filbeck, G. (2013). Alternative investments: Instruments, performance, benchmarks, and strategies. Hoboken: Wiley and Sons.

Crosson, V., & Belverd E., (2011). Needles. Managerial Accounting. Mason: South-Western Cengage Learning.

Bloomsbury. (2013). Good Small Business Guide 2013: How to start and grow your own business. London: Bloomsbury Publishing.

Read

More

CHECK THESE SAMPLES OF Financial Analysis of Apple Inc

Business Analysis Part II

financial analysis of apple indicates so many things about the company.... financial analysis of apple, Inc.... Apple Financial Analysis (Name) (University) (Course) (Tutor) apple inc.... Apple Financial Analysis apple inc.... Retrieved October 12, 2011, from apple inc: http://www.... Retrieved October 12, 2011, from apple inc: http://www.... apple inc: Financial Ratios and Returns....

3 Pages

(750 words)

Essay

Financial Analysis: Apple Inc

Journal Entries The financial statement of apple inc.... Journal EntriesThe financial statement of apple inc.... Financial Analysis: apple inc.... This report will look into the financial instruments used by apple inc.... for the year 2012 in the form of a 10 – K form is being used for analysis (apple inc.... The consolidated balance sheet for apple inc.... for the year 2012 in the form of a 10 – K form is being used for analysis (apple inc....

5 Pages

(1250 words)

Term Paper

Financial Reporting and Analysis of Apple

The paper "Financial Reporting and analysis of apple" observes Apple Inc.... he important factor influencing the decision to invest in apple inc.... analysis of financial statements for the past three years strengthens our decision to recommend this stock for investment to investors with a long-term point of view and with low to medium risk preference.... The company manufactures and sells apple-branded and other electronic devices like apple TV and digital video cameras....

11 Pages

(2750 words)

Essay

Financial Analysis of Apple Inc and Dell Inc

The author of the paper "Financial Analysis of Apple Inc and Dell Inc" will begin with the statement that as per the essence of prudence concept of accounting, assets should not be overvalued and liabilities should never be undervalued in the financial statements.... rnst & Young LLP is the audit firm that performs an external audit of apple inc.... and apple inc.... apple inc.... has disclosed liabilities and provisions relating to Marketable securities, Derivatives of Financial instruments, allowances for doubt full accounts (apple inc....

2 Pages

(500 words)

Essay

The Rapid Development of Apple Inc

The paper "The Rapid Development of apple inc" suggests that the rapid growth of Apple, over the years, can also be affirmed as a result of its commitment to delivering quality products and services, keeping pace with the continually changing preferences of its customers.... The rapid development of apple inc has been quite a significant topic of study in recent times owing to its aggressively competitive approach to sustenance.... As can be observed from the above conducted theoretical analysis of apple's performance, although the company has been able to secure its leadership position going through various ups and downs, the future probable rise in competition is likely to raise certain barriers to the trend in case of Apple....

9 Pages

(2250 words)

Research Paper

Financial analysis Apple and McDonald's

On the other hand, apple inc.... RatiosThe ratios explore the output and revenues generated by both apple inc.... However, the statements also demonstrate positive movements for the corporation since it has cut down on the percentage of sales associated with the cost of goods sold from financial analysis Apple and McDonalds Financial ments The financial ments indicate that for over one year, movement on McDonald's has been little in their bottom line area ranging from five-and-half billion United States dollars to five billion and sic million dollars....

2 Pages

(500 words)

Essay

Technological Company Apple Incorporated

apple inc.... The name was changed to apple inc.... The paper examines apple inc.... apple inc.... It looks at threats of substitutes and new entrants to the state of apple in the industry.... The three founders of apple are Steve Jobs, Ronald Wayne, and Steve Wozniak.... The company became Apple Computer inc.... This research paper "Technological Company apple Incorporated" looks at factors to understand how the firm operates....

10 Pages

(2500 words)

Research Paper

Financial Analysis of Apples Inc

In my opinion, this performance/strength over the past ten years proves that the stock of apple inc.... "Principles of Banking and Finance" paper contains recommendations to the investor regarding apple inc.... shows that apple inc.... Now that the investor has determined that apple inc.... is the second-largest information technology corporation in the world by revenue after Samsung Electronics and also the third-largest mobile phone maker in the world (Ximénez, & Sanz, 2014) As the financial manager, I have decided to recommend my investor that he/she invest heavily in the stock of the apple inc....

12 Pages

(3000 words)

Research Paper

sponsored ads

Save Your Time for More Important Things

Let us write or edit the on your topic

"Financial Analysis of Apple Inc"

with a personal 20% discount.

GRAB THE BEST PAPER

✕

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY